Campaigns

Latest News

-

ASU welcomes the passing of superannuation on paid parental leave through the Australian Parliament

19 September 2024 -

Super on paid parental leave is a super win for women workers

07 March 2024 -

Media Statement: O’Dwyer ducks the big issue in women’s statement

20 November 2018 -

Media Statement: Government must fix super inequality

09 September 2018 -

Qantas mega-profits trickle up... not down

14 February 2018

Superannuation & retirement

Stand up for Super

All Australians deserve a decent retirement

Australia’s universal superannuation system is the difference between poverty and a decent retirement for most Australians. Superannuation and the decisions that are made today will have a far-reaching impact on what retirement looks like for all hard-working Australians:

- It is the difference between using the heater during winter and having to shiver under a blanket.

- It is the difference between a healthy balanced diet or instant noodles for dinner.

- It is often the difference between being able to afford vital medications or not.

Australian families are worried about their future.

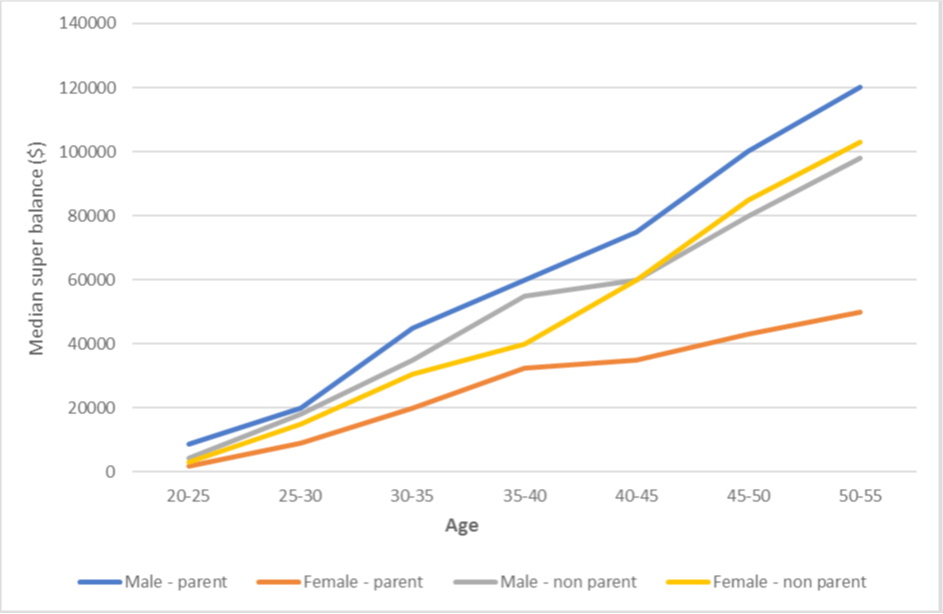

Just one in five Australians with superannuation said they expected to be able to live comfortably off their super in retirement. Many Australian women are retiring in poverty; older women are the fastest-growing cohort of people experiencing homelessness in Australia today.

What we want:

We want our elected representatives to stand up for super, to stand up and ensure every working Australian has a decent retirement. This means:

- Protecting our universal superannuation system and rejecting any attempts to make super optional for Australian workers

- Legislating to ensure superannuation is paid on every dollar earned by eliminating the $450 minimum threshold for compulsory employer contributions

- Keeping to the promised Superannuation Contribution Guarantee rate increase to 12%

- Closing the retirement gender super gap by paying a superannuation contribution at the prevailing SGC rate for the government’s paid parental leave scheme and on all government carer & family payments

Image: Stand Up For Super rally - Canberra Feb 2020